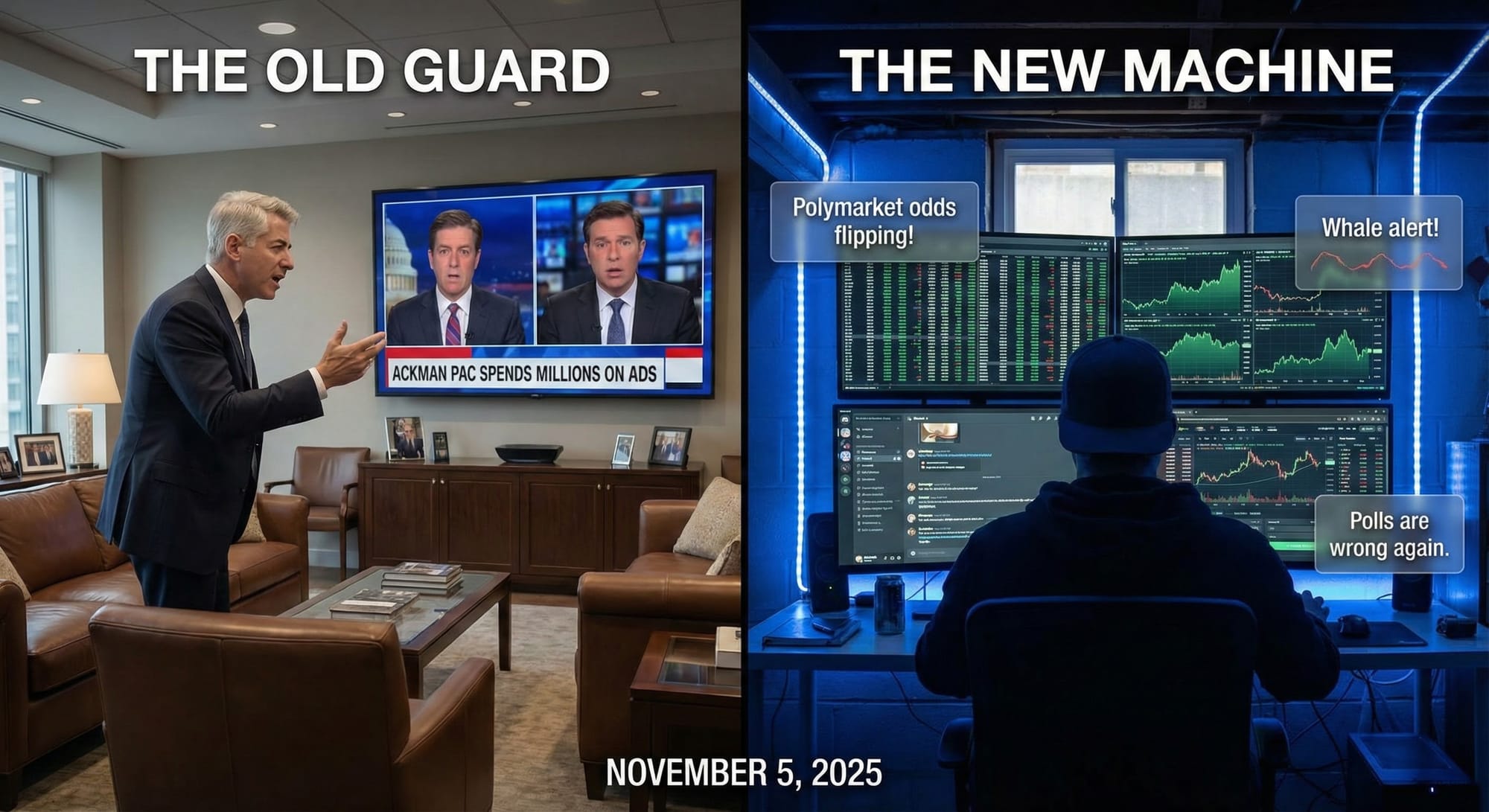

Bill Ackman saw it happening in real time and said what everyone else was too polite or too naive to say: someone was rigging the betting markets to make Zohran Mamdani's victory look inevitable. I knew months ago that Mamdani won, and there was nothing anyone could do. I knew it from multiple reliable sources that confirmed what I knew, and every day, the signs were on the wall more and more.

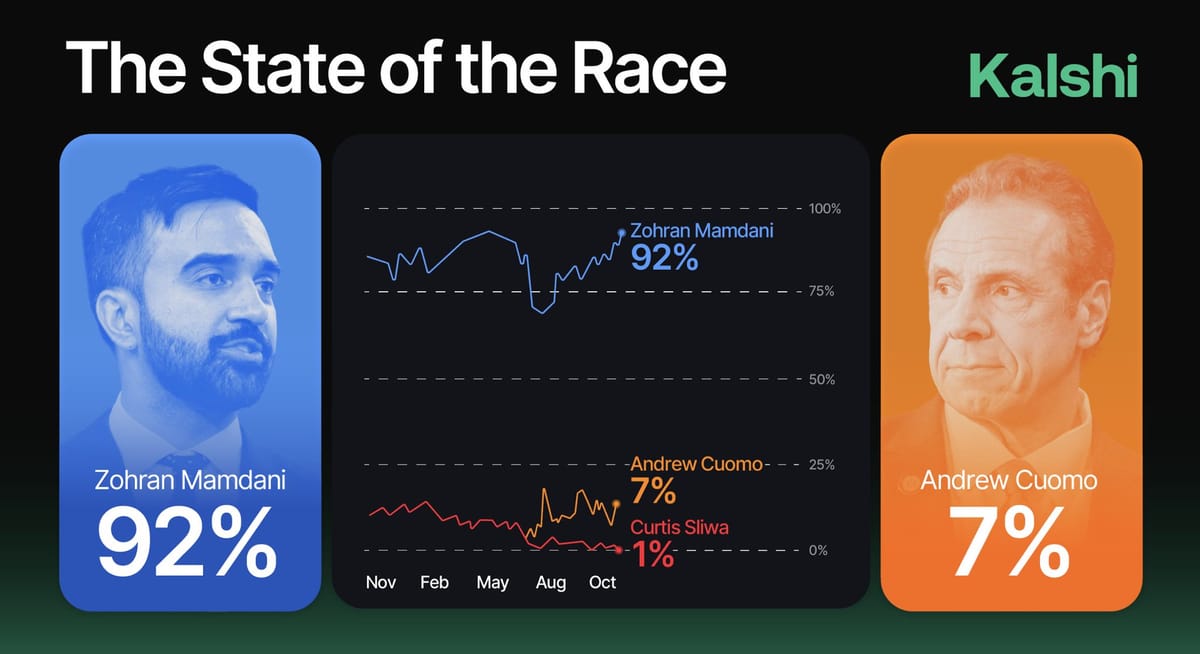

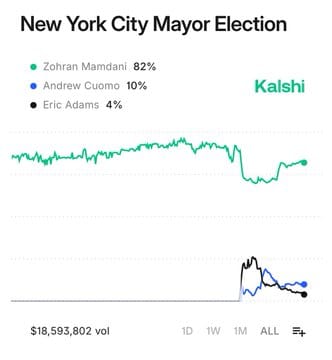

On October 24, 2025, with two weeks until New York's mayoral election, Ackman posted what should have been an obvious observation. Polymarket showed Mamdani with 92% odds of winning. Polls showed a closer race. Some anonymous account called "dubdubdub2" had dumped over a million dollars into Mamdani shares. The odds hadn't moved in weeks despite new polls, major endorsements, and Trump backing Cuomo.

"The problem is that it takes only a small amount of capital to influence Polymarket trading levels," Ackman wrote. He was right.

Here's what everyone wants to ignore: Mamdani winning doesn't prove the markets weren't manipulated. It proves the manipulation worked.

When Winning Proves The Point

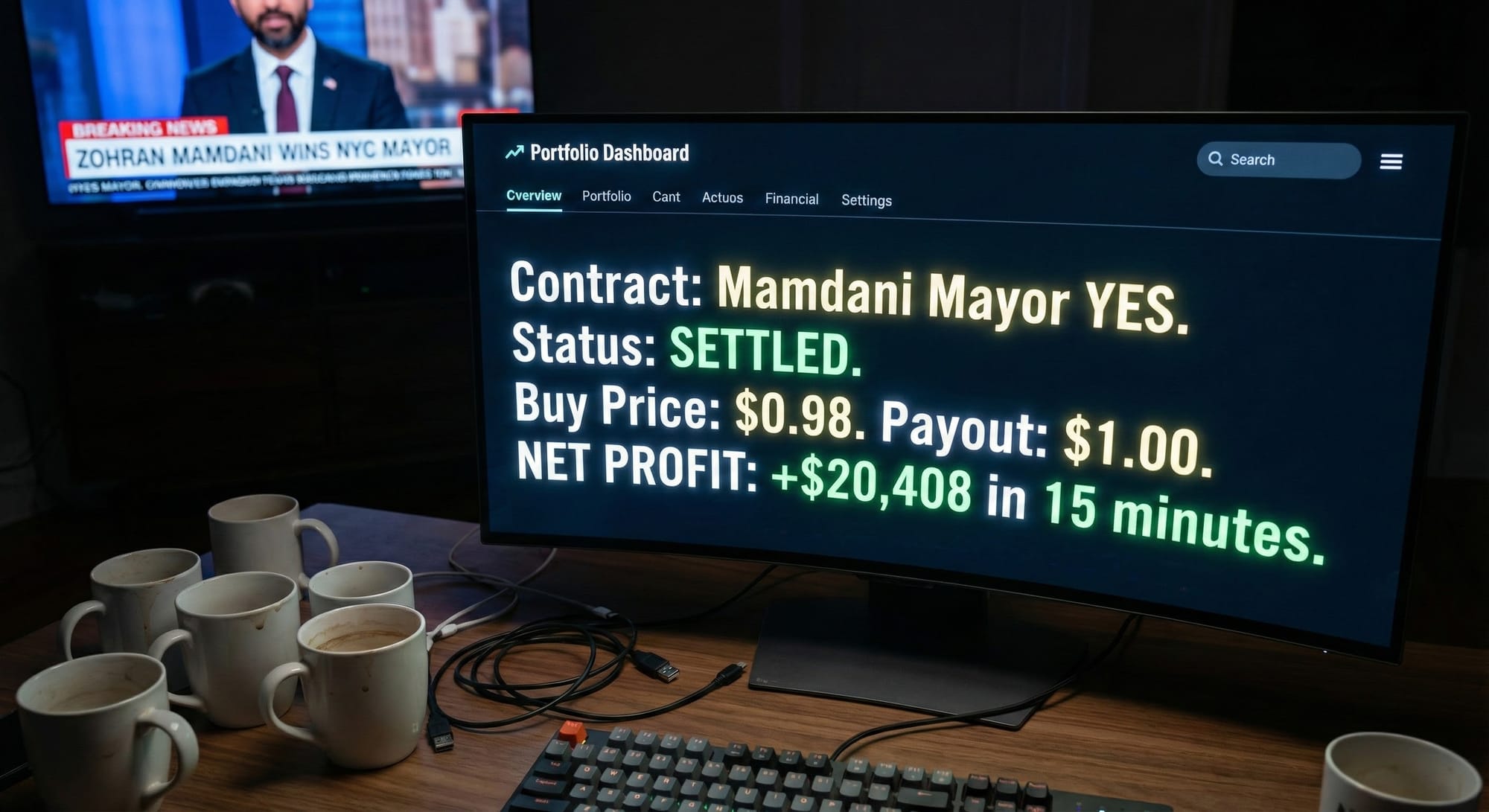

The standard response goes like this: dubdubdub2 made $141,554, so obviously they had superior information, not manipulation. The market was right, so stop complaining.

This is backwards logic and everyone pushing it knows it.

If I spend a million dollars inflating a candidate's odds to 95%, and those inflated odds suppress opposition turnout, demoralize the opposing campaign, and create a media narrative of inevitability, then my candidate winning validates the manipulation. It doesn't disprove it.

Ackman understood this. He spent $1.75 million on legitimate campaign activity, traditional political engagement, supporting candidates and causes he believed in. That's democracy. That's how it's supposed to work. You make your case, you fund your causes, you let voters decide.

What he was calling out was something different: using unregulated financial markets to create a false perception of inevitability. When hundreds of thousands of New Yorkers walk through Penn Station and see digital billboards showing Mamdani at 93% odds of winning, that's not neutral information. That's psychological warfare.

The Money That Moved Mountains

Let's look at what actually happened in these markets, because the pattern is clear once you see it.

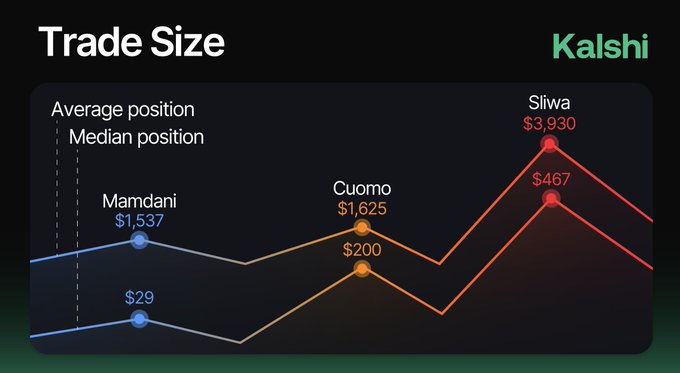

Polymarket's NYC mayoral race saw $424 million in total volume. But the distribution of that volume tells the real story. A handful of accounts controlled massive positions. dubdubdub2 wasn't alone. Multiple whale accounts steadily accumulated Mamdani shares, often buying when prices were already high.

Chaos Labs analyzed Polymarket's blockchain data and found that roughly one-third of trading volume on the 2024 presidential market was "wash trading," where traders buy and sell their own shares to create artificial volume and momentum. One third. That's not a fringe problem. That's systemic manipulation baked into the platform.

The industry response? Nothing. Because wash trading makes the markets look more liquid and legitimate than they are. Polymarket reported 200,000 daily active users and used those numbers to secure an $8 billion valuation from Intercontinental Exchange. Why would they crack down on behavior that makes their metrics look better?

The prediction market industry went from zero to $10 billion in valuation in four years. That didn't happen because of accuracy. That happened because of volume, and volume can be faked.

The French Trader Everyone Got Wrong

Everyone loves the story of "Théo," the French trader who bet $80 million on Trump and won $85 million. Look how smart he was! He did neighbor polls! He had superior information!

Let's be clear about what actually happened. One person, using 11 different accounts to disguise his position, bet $80 million on a presidential election. That's not market wisdom. That's one guy with the resources to move an entire market.

Yes, he commissioned neighbor polls through YouGov. That's interesting methodology. But here's what nobody wants to discuss: did his massive bets themselves influence the outcome?

When Polymarket showed Trump at 70% while traditional polls showed a dead heat, that created media narratives. Every outlet from Bloomberg to CNN was citing Polymarket odds. "The smart money says Trump." Did that influence turnout? Did it influence campaign strategy? Did it create bandwagon effects?

We'll never know, because nobody studies this. But we do know that Théo's $80 million moved Trump's odds significantly higher than they would have been otherwise. Whether he was right or not is beside the point. The point is that one person had that much influence.

And by the way, Polymarket investigated and found "no evidence of manipulation." Of course they didn't. They just took a massive investment from ICE and brought Nate Silver on as an advisor. Finding manipulation would destroy their business model.

The Romney Whale Who Proved The System Fails

The 2012 InTrade situation proves exactly what Ackman was warning about.

Some trader poured between $4 and $7 million into Romney contracts in the final two weeks, when Obama was pulling away in legitimate polls. Economists who studied this concluded it was likely manipulation intended to create a narrative of Romney momentum, boost fundraising, and influence turnout.

The trader lost everything when Obama won. Everyone cites this as proof that manipulation doesn't work.

That's not what it proves. It proves that unsuccessful manipulation fails. But what about successful manipulation? How would we even detect it?

If someone spends millions to inflate their candidate's odds, and those inflated odds contribute to their candidate's victory, everyone just says "see, the market was right." The manipulation becomes invisible because it worked.

What The Data Actually Shows

Yes, prediction markets have been more accurate than polls recently. That's true. It's also irrelevant to whether they're being manipulated.

Polymarket correctly called the 2024 presidential election. It also had one-third of its volume coming from wash trading. Both things can be true.

The markets got Biden's dropout right. They also failed to predict the timing by weeks and went through wild swings based on single news stories.

They nailed the NYC Democratic primary. They also showed Cuomo with 85% odds of winning a week before the vote, then completely reversed.

Cherry-picking successful predictions while ignoring the manipulation, the wash trading, and the wild volatility is how you sell a narrative. It's not how you analyze what's actually happening.

Traditional polls have problems. Obviously. But at least pollsters follow ethical guidelines. They embargo results until after voting. They disclose methodology. They're trying, however imperfectly, to measure public opinion without influencing it.

Prediction markets have zero such constraints. Kalshi and Polymarket plaster Times Square with election odds that update in real time. They're not trying to measure opinion. They're trying to influence it while profiting from the influence.

The Regulation That Isn't Coming

Here's why Ackman's warnings matter: nobody is fixing this.

The CFTC under Biden tried to shut Polymarket down. Under Trump, they ended the investigation. Donald Trump Jr. now has an advisory role at Polymarket. The company has explicit political protection from the administration.

Kalshi is regulated by the CFTC, but those regulations don't cover the things that matter. No disclosure requirements for large positions. No limits on whale behavior. No embargo periods like traditional polls use. No restrictions on public advertising of odds during voting periods.

The industry is operating in a regulatory vacuum by design. When you're moving billions of dollars and potentially influencing electoral outcomes, that vacuum is a feature, not a bug.

Polymarket just raised money at an $8 billion valuation. Kalshi reported 5 million trades in October 2025 alone. The money is getting bigger, the influence is growing, and the regulation is going backwards.

Why The Response To Ackman Was Wrong

When Ackman raised concerns about market manipulation, the response was immediate and predictable: he's just mad because his candidate is losing. He spent $1.75 million on anti-Mamdani PACs, so of course he's complaining.

This is a thought-terminating cliche. Yes, Ackman had a position. That doesn't make his concerns invalid.

If anything, people with positions are the ones paying attention. The academics writing papers about prediction markets three years after the fact aren't watching the blockchain data in real time. The journalists aren't tracking whale accounts and wash trading. The people actually involved in campaigns are seeing the manipulation happen and nobody wants to listen because they have "conflicts of interest."

Ackman was right about the specific trading pattern being suspicious. He was right that buying Mamdani shares at 95 cents to make 5 cents was economically irrational unless the goal was manipulation rather than profit. He was right that small amounts of capital can move these markets significantly.

The fact that Mamdani won doesn't refute any of this. It confirms it.

The Uncomfortable Question Nobody Asks

Here's what keeps me up at night about prediction markets: we have no baseline for what elections would look like without them.

In 2020, there was $1 billion in election betting volume. In 2024, there was $3.7 billion. In 2025's NYC race, there was $424 million just for mayor.

That money is creating information that millions of people see. It's shaping media narratives. It's potentially influencing turnout and strategy. And we have absolutely no idea what the effect is because we've never had a controlled experiment.

Maybe the markets are just accurately reflecting reality. Or maybe they're creating reality and we're all pretending they're just measuring it.

Traditional polls can be wrong without being manipulated. Prediction markets can be right while being manipulated. These aren't contradictory concepts, but people treat them like they are.

What Happens Next

The answer is probably nothing. The industry is too big now, too well connected, too profitable. Polymarket has ICE's $2 billion investment. Kalshi has CFTC approval. Both have political protection.

The manipulation will continue because calling it "superior information" is more convenient than admitting we've created financial instruments that can influence democratic outcomes.

Ackman saw it. He said it. Everyone ignored him because he had the audacity to care about the outcome.

The next time some whale drops millions on a political outcome and the odds shift dramatically, remember this: just because they turn out to be right doesn't mean they weren't rigging the game. Sometimes rigging the game is how you get the outcome you bet on.

That's not superior information. That's just corruption with better PR.

Get In The Game (Because Someone Else Already Is)

Look, we just explained how prediction markets are likely being manipulated by whales with massive resources. Your response shouldn't be to opt out. It should be to participate.

Sign up for Kalshi with our affiliate link and get $10 to start trading. Full disclosure: we also get $10 when you sign up. That's how affiliate marketing works.

Why are we promoting prediction markets after spending 1,500 words explaining the manipulation problem? Because the manipulation is happening whether you participate or not. The whales are moving markets. The question is whether you're paying attention or getting played.

Kalshi is the only major prediction market that's actually legal and regulated for US users. No VPN required. No crypto wallet needed. Regular bank account funding. CFTC oversight. It's not perfect, but it's legitimate.

The 2026 midterms already have active markets. Every major political event has markets. There's information in the price movements, even if some of that movement comes from manipulation. Learning to read those signals matters.

Sign up. Watch the markets. See where the money is going. You don't have to bet big. But you should understand what's happening, because these markets are influencing outcomes whether you're watching or not.

Affiliate Disclosure: The Unredacted participates in the Kalshi affiliate program. When you sign up through our link, you receive $10 in trading credit and we receive a $10 commission. This costs you nothing beyond your initial deposit and helps fund independent investigative journalism. We recommend Kalshi because it's the only major prediction market operating legally in the US with CFTC regulation. Trading involves risk. Don't bet money you can't afford to lose. We are not financial advisors and this is not investment advice. This disclosure is required by FTC guidelines and our own commitment to transparency.